Mint doesn’t charge users a fee instead, they partner with these various companies to cover costs. You will see recommended financial products every time you use the Mint budgeting app. Furthermore, if you use a small institution, you might have difficulty adding it to your account.Ĭonstant Advertisements for More Financial Products Furthermore, Mint may have problems connecting to certain financial accounts at times. Users complain of occasional account connection issues. You have to edit the categories and fix them manually if this happens. However, sometimes the app will assign expenses to the wrong classification. Mint offers automatic category assignments, which can be helpful. Furthermore, you might want to allocate some time to learn the new budgeting app to reap the most benefit from its features. Depending on how many accounts you need to link, it can take time to input your information. You have to create a complete account to use Mint. You can turn off mobile device access or delete your mobile account remotely from a computer if something happens to your phone.

#Pros and cons of intuit mint code#

Plus, your info is safe with strong encryption you also have to complete multi-factor authentication, further protecting your account.įeel free to add more safeguard measures like a four-digit security code to your mobile devices. Intuit uses the trusted VeriSign to transfer data securely. Why? Because Intuit follows the latest security protocols for all of its products, including Mint.

Since Intuit is the owner of Mint, you can expect the utmost in security. With these free credit monitoring tools, you can see your TransUnion Vantage Score, along with helpful insights into how your score is calculated and the steps you can take to raise it.

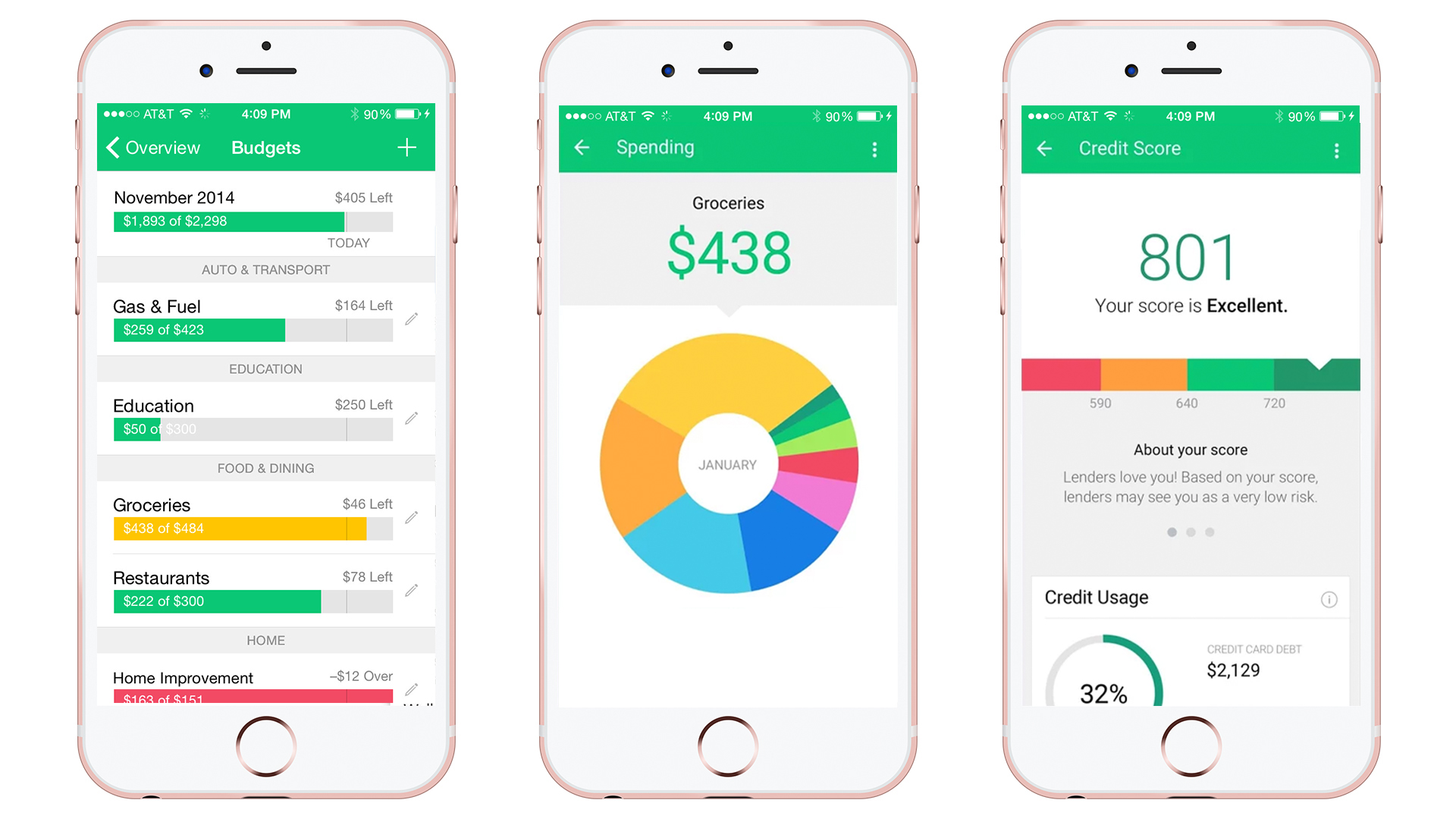

Thanks to a soft credit check, you’ll be able to view and track changes to your credit score, and it won’t negatively impact your score itself. That includes paying off your debt, saving money, or boosting your credit score. Also neat.Set and track specific financial goals using Mint. it’s nice that you can see credit score tips and stuff and see it improving over time. Easy since it imports transaction data from your bank accounts. i’ve used it before (free version) with some success- I didn’t really know what I was doing when setting my budgeting goals, but the app/site was fine for tracking my spending and saving. Mint isn’t really educational but is a common budget tracker tool. Understanding finances, budgeting, etc ADHD style You don’t need to do this manually, check out You Need a Budget or Mint, or google and find a website or example that works for you. talking about your brand new houses and cars. How the fuck do you people have so much money. As an example, I use a widget of Mint by. Maybe getting too technical here and I'm by no means a technical expert, but wouldn't you need to be authenticated in order for the app to push that kind of specific info? If the need is quick access to metrics, I'd suggest looking at creating a widget that uses a token authentication rather than having to open up a presumably larger app that needs more resources, etc. See r/mintuit if you want to know more from Reddit, or direct site.

Basically does an automatic version of manually copying your bank statements into a XL file and writing your own formula.

#Pros and cons of intuit mint for free#

You can use it for free and it has ability to connect to all your accounts and track transactions, budget, as well as basic goals. Just since you're new, I'll make a small plug for Intuit's Mint budgeting platform. Using Excel to track bank balances, any templates? If you aren't good at tracking your expenses, apps like Mint can do it for you. This will help you see where the money is going, and also draw up a realistic budget going forward. But one thing worth doing in parallel, is to start tracking your expenses. Others have already mentioned good advice on handling debt.

0 kommentar(er)

0 kommentar(er)